Life insurance is more than just a financial product—it’s a safety net that safeguards the future of your family. Imagine this: you work hard every day, provide for your loved ones, and build a life together. But what happens if something unexpected occurs? Life insurance steps in to ensure your family stays secure, even when you're not around. It's not a fun topic to talk about, but it's one of the most important decisions you'll ever make.

Let's be honest, life insurance isn't exactly the most exciting subject to dive into. But hey, it's crucial. Think of it as an invisible guardian that protects your family from financial chaos if the worst happens. Whether you're a young professional just starting out or a parent with kids to support, life insurance is a smart investment. It’s not about being pessimistic; it's about being prepared.

Now, I know what you're thinking—life insurance sounds complicated and expensive. But guess what? It doesn't have to be. With the right information and guidance, you can find a policy that fits your budget and needs. In this article, we'll break down everything you need to know about life insurance, from the basics to the benefits, and help you make an informed decision. So, let's get started, shall we?

Read also:Isabel May Discovering The Current Partner And Personal Journey

Understanding Life Insurance: What Is It Really?

Alright, let’s clear up the basics first. Life insurance is essentially a contract between you and an insurance company. You pay regular premiums, and in return, the company promises to pay a lump sum of money (called the death benefit) to your beneficiaries when you pass away. Simple enough, right? But there's more to it than just that.

Life insurance isn’t just for the wealthy or older folks. It’s for anyone who wants to protect their loved ones financially. Whether you're a single parent, a married couple with kids, or even a young professional, having life insurance can bring peace of mind. It ensures that your family won’t face financial hardships if something happens to you.

Why Do You Need Life Insurance?

Here’s the deal: life insurance isn’t just a “nice-to-have.” It’s a “must-have” for most people. Think about it—your family depends on you for so many things, including financial support. If you're gone, how will they cover daily expenses, mortgages, or even college tuition? Life insurance steps in to take care of those things.

Let me give you a real-life scenario. Say you’re a breadwinner with a mortgage, car payments, and kids who will need college funds in the future. Without life insurance, your family might struggle to keep up with these expenses. But with a solid policy in place, they’ll have the financial cushion they need to keep moving forward.

Types of Life Insurance Policies

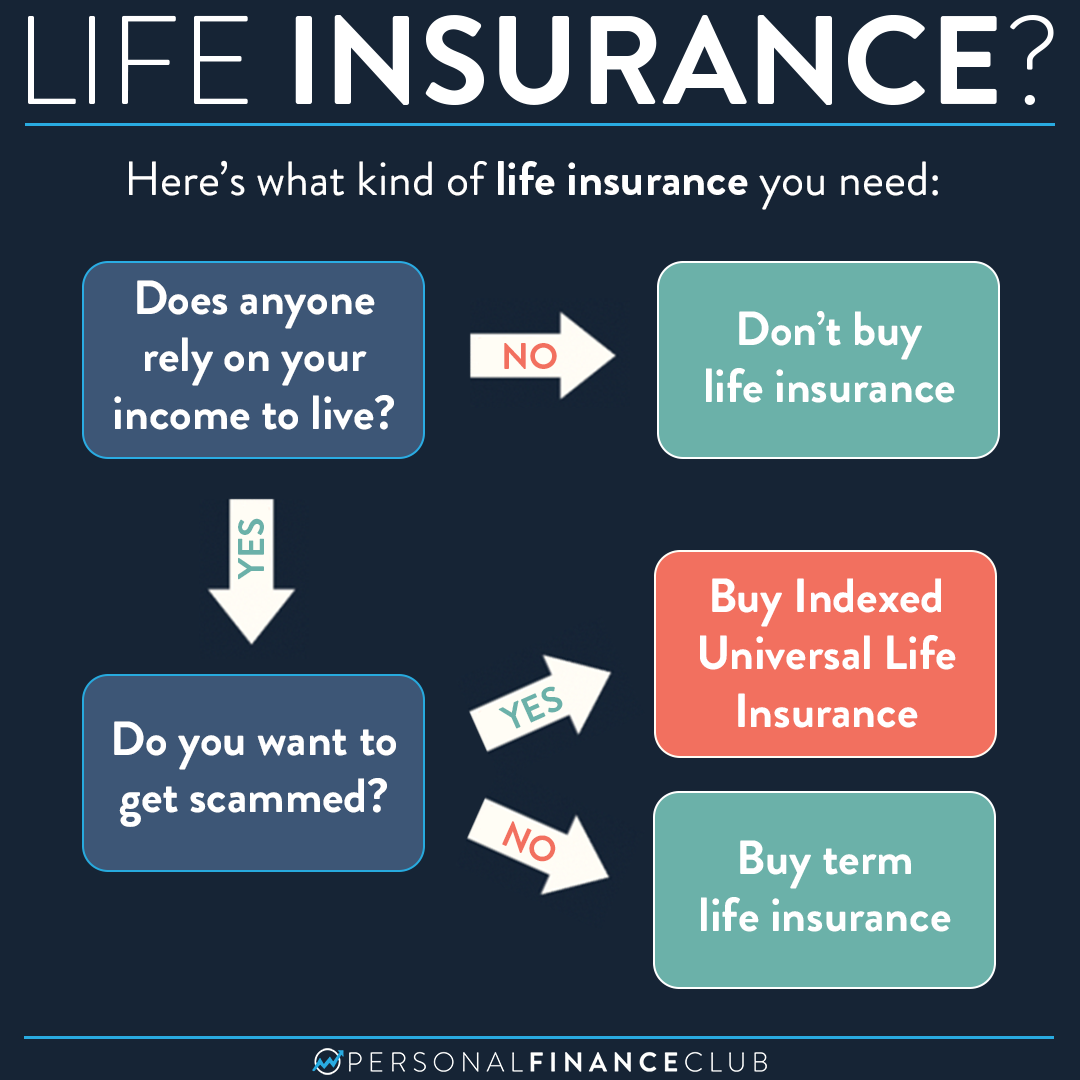

Not all life insurance policies are created equal. There are different types of life insurance, each designed to meet specific needs. Let’s break them down:

- Term Life Insurance: This is the simplest and most affordable type. It covers you for a specific period, like 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive the death benefit. But if you outlive the term, the policy ends.

- Whole Life Insurance: This one lasts your entire life, as long as you keep paying the premiums. It also has a cash value component that grows over time, which you can borrow against or withdraw.

- Universal Life Insurance: Similar to whole life, but it offers more flexibility. You can adjust your premiums and coverage amounts as your needs change.

Choosing the right type of policy depends on your financial goals and lifestyle. For example, if you’re looking for affordable coverage for a set period, term life might be the way to go. But if you want lifelong protection and a cash value component, whole life or universal life could be better options.

Read also:Jack Gibbens A Rising Star In The World Of Sports And Entertainment

Term vs. Permanent Life Insurance

Let’s dive deeper into the two main categories: term and permanent life insurance. Term life is straightforward and budget-friendly, making it ideal for people who need coverage for a specific period. Permanent life, on the other hand, offers lifelong protection and additional benefits like cash value accumulation.

Here’s a quick comparison:

- Term Life: Affordable, temporary coverage.

- Permanent Life: More expensive, lifelong protection, and cash value growth.

Ultimately, your choice will depend on your financial priorities and how much you’re willing to spend. Both options have their merits, so it’s important to weigh the pros and cons before making a decision.

Factors to Consider When Buying Life Insurance

Purchasing life insurance isn’t as simple as picking a policy and signing on the dotted line. There are several factors to consider to ensure you’re getting the right coverage. Here’s what you need to think about:

Your Age and Health

Your age and health play a huge role in determining your premiums. The younger and healthier you are, the lower your rates will be. That’s why experts recommend getting life insurance early, even if you don’t think you need it right now. As you age or develop health issues, your premiums can skyrocket.

Your Financial Responsibilities

Think about your family’s financial needs. Do you have a mortgage to pay off? Are there kids who will need college funds? Do you want to leave behind a legacy? All of these factors will influence the amount of coverage you need.

Your Budget

Life insurance doesn’t have to break the bank. You can find affordable policies that fit your budget. Just make sure you’re not underinsured. It’s better to pay a little more now than leave your family underprotected later.

How Much Life Insurance Do You Need?

Figuring out the right amount of coverage can feel overwhelming. But don’t worry—we’ve got a few tips to help you out. A general rule of thumb is to aim for a policy that covers 10-15 times your annual income. However, this can vary depending on your financial obligations.

Consider the following:

- Outstanding debts (mortgage, car loans, etc.)

- Future expenses (college tuition, weddings)

- Living expenses for your family

- Final expenses (funeral costs, estate taxes)

Adding up all these costs will give you a clearer picture of how much coverage you need. Remember, it’s always better to overestimate than underestimate. You don’t want to leave your family shortchanged.

Using Life Insurance Calculators

If math isn’t your strong suit, don’t sweat it. There are plenty of life insurance calculators available online that can help you estimate the right amount of coverage. Just input your details, and the calculator will do the rest. It’s a quick and easy way to get a rough estimate.

The Benefits of Life Insurance

Life insurance isn’t just about covering your family’s expenses. It offers a range of benefits that make it a worthwhile investment. Here are some of the top advantages:

Financial Protection for Your Loved Ones

The primary benefit of life insurance is the financial security it provides for your family. Whether it’s paying off debts, covering daily expenses, or funding future goals, life insurance ensures your loved ones are taken care of.

Cash Value Accumulation

If you opt for a permanent life insurance policy, you’ll enjoy the added benefit of cash value accumulation. This cash value grows over time and can be used for various purposes, like paying off loans or supplementing retirement income.

Tax Advantages

Life insurance offers some tax benefits too. For instance, the death benefit is usually tax-free, meaning your beneficiaries won’t have to pay taxes on the money they receive. Additionally, the cash value growth in permanent policies is tax-deferred, allowing it to grow faster.

Common Misconceptions About Life Insurance

There are a lot of myths and misconceptions surrounding life insurance. Let’s debunk a few of them:

It’s Only for Older People

Wrong! Life insurance is for everyone, regardless of age. In fact, younger people often get better rates because they’re seen as lower risk. Don’t wait until it’s too late to secure affordable coverage.

It’s Too Expensive

Many people assume life insurance is out of their budget, but that’s not true. Term life insurance, for example, is incredibly affordable. You can find policies for as little as $10-$20 per month, depending on your age and health.

You Don’t Need It if You’re Single

Even if you’re single, life insurance can still be beneficial. It can cover funeral costs, outstanding debts, or even leave a legacy for your loved ones. Plus, getting coverage early ensures you lock in lower rates.

How to Choose the Right Life Insurance Company

Not all insurance companies are created equal. When choosing a provider, look for the following:

- Reputation: Choose a company with a strong track record and positive customer reviews.

- Financial Strength: Make sure the company is financially stable and has a high rating from agencies like A.M. Best or Standard & Poor’s.

- Customer Service: Good customer service is essential, especially when you need to file a claim.

Do your research and compare quotes from multiple providers before making a decision. It’s also a good idea to read the fine print and understand the terms and conditions of the policy.

Top Life Insurance Companies to Consider

Here are some of the best life insurance companies in the market:

- Prudential

- MetLife

- John Hancock

- New York Life

- MassMutual

Each of these companies offers a variety of policies and has a proven track record of reliability. Be sure to compare their offerings and choose the one that best fits your needs.

Final Thoughts: Why Life Insurance Matters

Life insurance is more than just a financial product—it’s a promise to protect the people you love. Whether you’re young or old, single or married, life insurance offers peace of mind and financial security. It ensures that your family won’t face financial hardships if something happens to you.

So, take the first step today. Assess your needs, compare policies, and choose a provider that aligns with your goals. Remember, the sooner you act, the better the rates you’ll get. And who knows? You might just sleep better at night knowing your loved ones are protected.

Got questions or comments? Drop them below, and let’s chat. Or if you found this article helpful, share it with your friends and family. Life insurance is too important to keep to yourself!