So here’s the deal, folks. Social security checks have become one of the most talked-about topics in recent years. Whether you're nearing retirement, already receiving benefits, or just curious about how this whole system works, it's super important to understand what social security checks are all about. These checks aren't just a number on a piece of paper; they're a lifeline for millions of Americans who rely on them to make ends meet. So buckle up, because we're about to dive deep into the world of social security checks!

Now, before we get into the nitty-gritty, let’s clear something up. Social security checks aren’t some mystical concept only understood by government officials or financial wizards. They’re actually pretty straightforward once you break it down. Think of them as a safety net designed to help you out when you’re no longer working full-time. And guess what? You’ve probably been paying into this system your whole working life, so it’s only fair that you know how to maximize those benefits when the time comes.

But hey, don’t worry if you’re feeling a bit overwhelmed. That’s why we’re here—to break it all down for you in a way that’s easy to digest. From how much you can expect to receive to potential pitfalls to watch out for, we’ve got you covered. So, grab a coffee, get comfy, and let’s talk about everything you need to know about social security checks. Let’s go!

Read also:Why Ucsd Womens Basketball Is Setting The Court On Fire

What Are Social Security Checks Anyway?

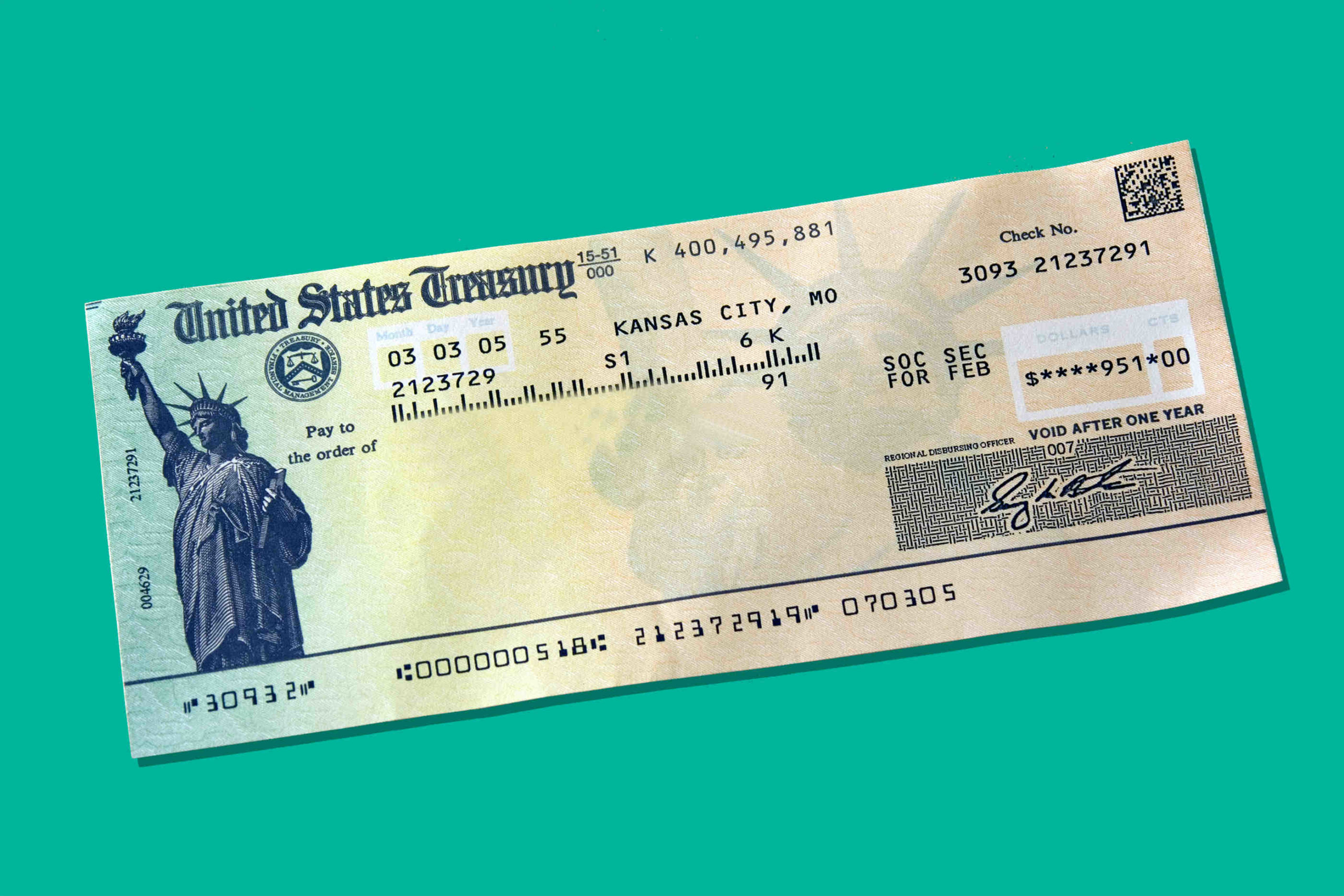

Alright, let’s start with the basics. Social security checks are payments made by the U.S. government to eligible individuals, usually retirees, disabled workers, and survivors of deceased workers. These payments are funded through payroll taxes that you and your employer contribute throughout your working years. It’s kind of like a long-term investment plan, except instead of stocks or bonds, you’re investing in your future financial security.

Now, here’s the kicker: not everyone qualifies for social security checks. To be eligible, you need to have accumulated enough "work credits" during your career. For 2023, you earn one credit for every $1,640 in covered earnings, up to a maximum of four credits per year. So if you’ve been working steadily for the past few decades, chances are you’ve racked up enough credits to qualify. But if you’ve taken long breaks from the workforce, you might want to double-check your eligibility.

Breaking Down the Numbers

Let’s talk numbers for a second. The average monthly social security benefit for retired workers in 2023 is around $1,681. But keep in mind, your actual benefit amount will depend on several factors, including how much you earned during your working years and the age at which you choose to start receiving benefits. If you opt to take your benefits early at age 62, your monthly check will be smaller than if you wait until your full retirement age, which is typically between 66 and 67, depending on when you were born.

Why Social Security Checks Matter

Here’s the thing: social security checks aren’t just a nice-to-have; for many people, they’re a necessity. According to the Social Security Administration, about 22% of married couples and 46% of unmarried individuals rely on social security for at least 90% of their income. That’s a pretty staggering statistic when you think about it. For millions of Americans, these checks represent the difference between being able to afford basic necessities like housing, food, and healthcare, and struggling to get by.

And let’s not forget the broader economic impact. Social security checks inject billions of dollars into the economy each month, supporting local businesses and helping to sustain communities. It’s a win-win situation: retirees get the financial support they need, and the economy benefits from their spending power. So yeah, social security checks are kind of a big deal.

Who Benefits from Social Security Checks?

- Retirees: The primary recipients of social security checks are retired workers who have reached their full retirement age.

- Disabled Workers: Individuals who are unable to work due to a qualifying disability can also receive social security benefits.

- Survivors: Family members of deceased workers, including spouses and dependent children, may be eligible for survivor benefits.

How to Maximize Your Social Security Checks

Now that we’ve covered the basics, let’s talk about how you can make the most of your social security checks. One of the biggest decisions you’ll face is when to start claiming your benefits. As we mentioned earlier, you can begin receiving payments as early as age 62, but your monthly benefit will be reduced if you choose this option. On the flip side, if you delay taking your benefits until age 70, you’ll receive a higher monthly payment for the rest of your life.

Read also:Nuggets Injury Report Stay In The Know About Your Favorite Teams Health

So how do you decide what’s best for you? It depends on a variety of factors, including your current financial situation, your life expectancy, and whether you have other sources of income. If you’re in good health and expect to live a long life, it might make sense to wait until age 70 to maximize your benefits. But if you’re in poor health or need the money sooner, claiming early could be the better choice.

Strategies for Maximizing Benefits

- Delay claiming benefits until age 70 to increase your monthly payment.

- Consider working part-time while receiving benefits to boost your income.

- Coordinate with your spouse to maximize household benefits.

Common Misconceptions About Social Security Checks

There’s a lot of misinformation floating around about social security checks, so let’s clear up a few common myths. First off, social security isn’t going broke anytime soon. While it’s true that the trust fund is projected to be depleted by the mid-2030s, that doesn’t mean the program will disappear. Even if the trust fund runs out, payroll taxes will still cover about 75% of scheduled benefits. So while there may be some adjustments in the future, the program isn’t going anywhere.

Another misconception is that social security checks are taxed at 100%. In reality, only a portion of your benefits may be subject to federal income tax, depending on your total income. And in some states, social security benefits aren’t taxed at all. So don’t panic if you hear someone talking about high taxes on social security checks—it’s probably not as bad as it sounds.

Myth vs. Reality

- Myth: Social security is going broke.

- Reality: The program is facing financial challenges, but it’s not disappearing anytime soon.

- Myth: Social security checks are taxed at 100%.

- Reality: Only a portion of your benefits may be taxable, depending on your income.

How Social Security Checks Impact Your Finances

Now let’s talk about how social security checks fit into your overall financial picture. For many retirees, these checks will be a significant part of their income, but they shouldn’t be the only source. It’s important to have a diversified retirement plan that includes savings, investments, and possibly other income streams like part-time work or rental properties. This way, if there are any changes to the social security program in the future, you’ll have a financial safety net to fall back on.

Another thing to consider is how social security checks will affect your taxes and other benefits. As we mentioned earlier, your benefits may be subject to federal income tax depending on your total income. And if you’re still working while receiving benefits, your payments could be temporarily reduced if you earn above a certain limit. But don’t worry—those withheld benefits will be returned to you once you reach your full retirement age.

Tax Implications

Here’s a quick rundown of how social security checks might impact your taxes:

- If your combined income is below $25,000 (single) or $32,000 (married filing jointly), your benefits won’t be taxed.

- If your combined income is between $25,000 and $34,000 (single) or $32,000 and $44,000 (married filing jointly), up to 50% of your benefits may be taxable.

- If your combined income is above $34,000 (single) or $44,000 (married filing jointly), up to 85% of your benefits may be taxable.

Future of Social Security Checks

So what does the future hold for social security checks? While the program isn’t going away anytime soon, there are some potential changes on the horizon. Lawmakers are exploring various options to ensure the long-term solvency of the program, including increasing payroll taxes, raising the full retirement age, and adjusting the benefits formula. These changes could impact how much you receive in benefits and when you’re eligible to start receiving them.

But don’t panic just yet. Any changes to the program will likely be phased in gradually, giving current and future retirees time to adjust their plans accordingly. And remember, social security checks are just one piece of the retirement puzzle. By staying informed and planning ahead, you can ensure a secure financial future for yourself and your loved ones.

Potential Changes to Watch Out For

- Increase in payroll taxes to fund the program.

- Raise in the full retirement age to reflect longer life expectancies.

- Adjustments to the benefits formula to account for inflation and cost of living changes.

Conclusion

Alright, folks, that’s the scoop on social security checks. Whether you’re already receiving benefits or just starting to think about retirement, understanding how the system works is crucial for securing your financial future. From eligibility requirements to strategies for maximizing your benefits, there’s a lot to consider. But with a little planning and some smart decision-making, you can make the most of your social security checks and enjoy a comfortable retirement.

So what’s next? If you found this article helpful, feel free to share it with your friends and family. And if you have any questions or comments, drop them in the section below. We’d love to hear from you! And hey, if you’re looking for more tips on retirement planning and financial security, be sure to check out our other articles. Until next time, stay informed and keep those social security checks rolling in!

Table of Contents